Mobility can become more challenging as we age, making wheelchairs necessary for getting around and maintaining our independence.

However, the cost of this equipment can be significant, leading many seniors and their families to wonder if they can get their wheelchairs covered through Medicare.

Well, the good news is that yes, Medicare does help cover the cost of wheelchairs, but only under specific conditions.

There are certain guidelines and eligibility requirements you need to meet though in order to take advantage of these benefits.

In this guide, we’ll explain how Medicare’s coverage for wheelchairs works, what types of wheelchairs are covered, and the process of obtaining one through Medicare.

After reading, you’ll know everything you need to in order to get your wheelchair covered by your insurance.

Does Medicare Cover Wheelchairs?

Yes, Medicare Part B (Medical Insurance) covers wheelchairs as Durable Medical Equipment (DME) if they are deemed medically necessary.

To qualify, a doctor or healthcare provider must prescribe a wheelchair and it must be essential for the patient’s ability to move within their home.

As straight-forward as that seems, there’s actually quite a bit more to it than it sounds.

Let’s start from the beginning…

Types of Wheelchairs Medicare Covers

Medicare typically covers two main types of wheelchairs:

- Manual Wheelchairs: These are basic wheelchairs that require the user or another person to push the chair.

- Power Wheelchairs: These are motorized wheelchairs for individuals who are unable to operate a manual wheelchair due to a medical condition.

Medicare coverage varies depending on your mobility needs and the type of wheelchair prescribed will depend on the severity of your condition and your ability to use the wheelchair safely.

Medicare Eligibility Requirements for Wheelchairs

To qualify for Medicare coverage for a wheelchair, several conditions must be met:

Medical Necessity

A healthcare provider must confirm that a wheelchair is medically necessary for your condition.

This typically means you have difficulty moving around within your home, and a cane or walker is not sufficient to meet your needs.

Medical necessity can sometimes be a gray area because some seniors may technically be able to get around with a walker, but it may be exhausting or less than safe.

In these cases, the senior will still likely qualify for a wheelchair though, assuming their doctor believes it’s necessary.

Sometimes home health physical/occupational therapists can assist with determining medical necessity, but ultimately, the doctor has to agree it’s necessary.

Helpful hint: Medicare also covers most walkers, so if you don’t qualify for a wheelchair, you may be able to get a walker instead.

Doctor’s Prescription

Speaking of which, you must have a prescription from a doctor or healthcare provider who is enrolled in Medicare.

The prescription should specify whether you need a manual or power wheelchair based on your mobility limitations.

Your healthcare provider will likely need to send in visit notes as well to prove medical necessity.

Home Use

Medicare will only cover a wheelchair if it is required for use inside your home.

If you only need a wheelchair for use outside of the home (e.g., running errands or going to appointments), Medicare may not cover it.

Medicare-Approved Supplier

The wheelchair must be purchased (or rented) from a supplier that is approved by Medicare and accepts Medicare assignment.

This ensures that you will not be overcharged for the equipment.

How Much Does Medicare Pay for Wheelchairs?

If you qualify for a wheelchair under Medicare Part B, Medicare typically covers 80% of the approved cost, while you are responsible for the remaining 20%, as well as any unmet deductible for the year.

FYI, the Part B deductible in 2024 was $240.

Here’s an example breakdown of potential costs:

- Manual wheelchair cost: $500

- Medicare pays: $400 (80%)

- You pay: $100 (20%) + any unmetdeductible

If you have a Medigap (Medicare Supplement Insurance) plan, it may cover some or all of your out-of-pocket costs, including the 20% coinsurance.

For power wheelchairs, the cost may be higher, and the approval process may involve additional steps, such as an in-person evaluation by a Medicare-approved physician or specialist.

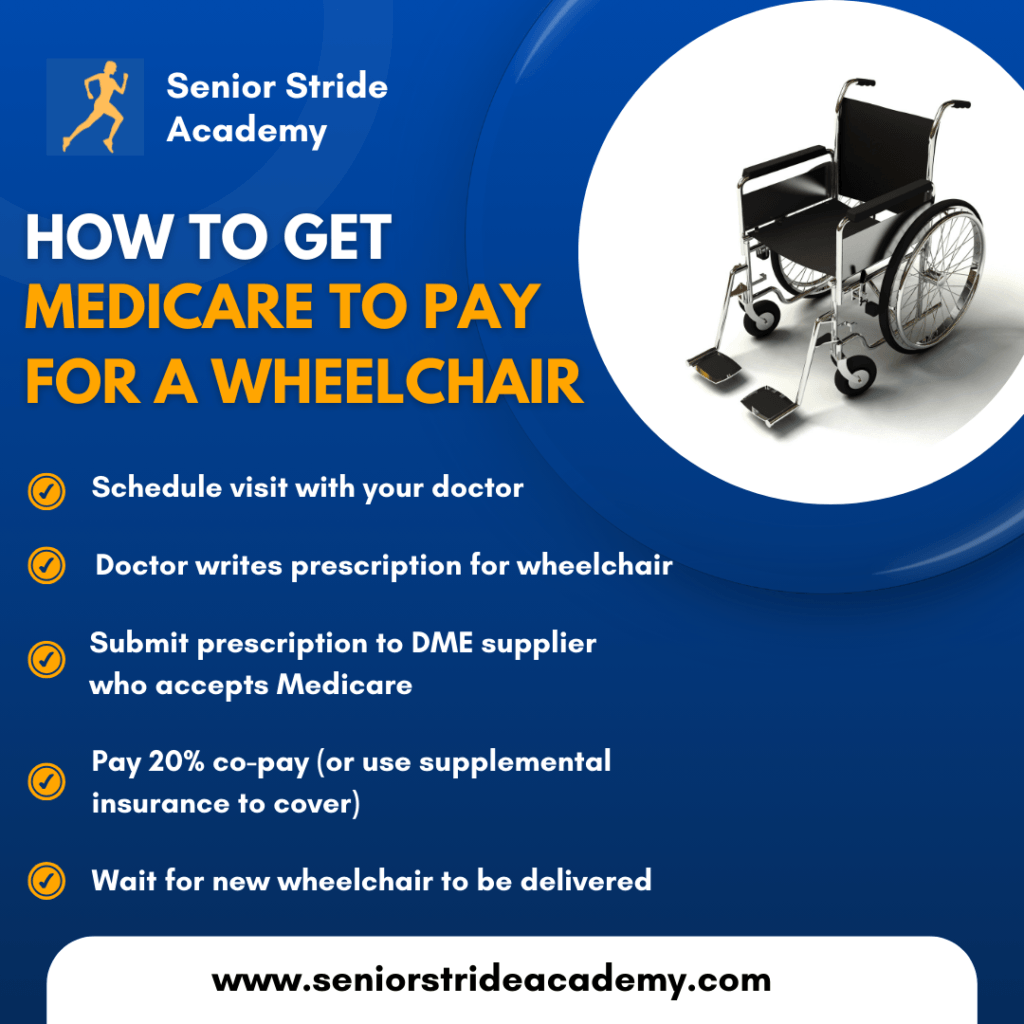

How to Get a Wheelchair Through Medicare: Step-by-Step

If you need a wheelchair and plan to get it through Medicare, follow these steps to ensure your equipment is covered:

1. Visit Your Doctor

Schedule an appointment with your doctor to discuss your mobility challenges.

Your doctor will evaluate your condition and determine whether a wheelchair is medically necessary. If so, they will write a prescription for a wheelchair.

Before you see your doctor, make sure they know in advance that the appointment is specifically for a wheelchair assessment.

2. Undergo an In-Person Examination (for Power Wheelchairs)

If you need a power wheelchair, you will be required to undergo an additional in-person examination by a doctor or specialist.

This is a Medicare requirement to ensure that the power wheelchair is the appropriate option for your condition and that it will actually work inside your home.

3. Choose a Medicare-Approved Supplier

Once you have a prescription, the next step is to find a Medicare-approved DME supplier.

You can use Medicare’s Supplier Directory to find an approved supplier in your area, but your doctor may have a DME supplier they like to use.

If you find yourself doing the dirty work though, make sure to choose a supplier that accepts Medicare assignment to avoid paying more than the 20% coinsurance.

You can call the DME suppliers directly to make sure they accept Medicare.

4. Submit the Prescription and Order Your Wheelchair

Provide the prescription from your doctor to the Medicare-approved supplier of your choice.

They will handle the paperwork and submit the claim to Medicare for approval and hopefully get the ball rolling for getting your wheelchair covered.

The best case scenario is that your doctor will fax the prescription (and any other necessary paperwork) over to the DME supplier directly, meaning you won’t have to worry about any of this.

But this often isn’t the case.

As a physical therapist, I often find myself playing the middle-man, helping to communicate between the DME companies and the doctors’ offices.

It’s always nice when the doctors can send everything directly to the suppliers though.

5. Pay the Coinsurance and Deductible

After Medicare processes the claim, you will be responsible for paying the 20% coinsurance and any deductible that remains for the year.

If you have a secondary insurance plan, they may cover the remaining 20%.

6. Receive Your Wheelchair

Once the claim is approved and payment is made, your supplier will provide your wheelchair, either through purchase or rental, depending on your specific needs.

What If Medicare Doesn’t Cover My Wheelchair?

If you don’t meet Medicare’s requirements for wheelchair coverage, there are still other options available:

- Medicaid: For those who qualify for Medicaid, it may help cover the cost of a wheelchair. Medicaid coverage rules vary by state, so be sure to check your local regulations.

- Private Insurance: Some private health insurance plans offer coverage for durable medical equipment like wheelchairs. Review your policy for DME coverage details.

- Out-of-Pocket: You can always purchase or rent a wheelchair on your own. While this may require paying the full cost, it allows you to select any model you prefer, even if it is not covered by Medicare. If you have to go down this route, I highly recommend checking Amazon because they have plenty of affordable options.

- Non-Profit Assistance: There are non-profit organizations and community programs that help seniors obtain mobility aids like wheelchairs at reduced or no cost. Research local resources in your area that offer assistance.

Medicare Advantage Plans and Wheelchairs

If you are enrolled in a Medicare Advantage (Part C) plan, your coverage for wheelchairs may differ slightly from Original Medicare.

Medicare Advantage plans are required to cover the same services as Medicare Part B, including DME, but they may have different rules about network suppliers, prior authorization, or copayments.

Check with your Medicare Advantage plan provider to learn more about their specific coverage for wheelchairs and any additional steps you may need to take to get one.

Renting vs. Buying a Wheelchair Through Medicare

Depending on your needs and the type of wheelchair, Medicare may either rent or buy the wheelchair for you.

Generally, Medicare may rent a wheelchair if it’s needed for a shorter period, while more permanent or long-term needs may lead to Medicare purchasing the wheelchair outright.

- Renting a Wheelchair: Medicare often rents equipment like wheelchairs if the expected use is temporary or if it’s more cost-effective for Medicare to rent than buy. In this case, Medicare will cover 80% of the rental cost, while you are responsible for the remaining 20%.

- Buying a Wheelchair: For long-term use or when deemed more practical, Medicare will buy the wheelchair outright. You’ll still be responsible for 20% of the cost and any remaining deductible.

Discuss with your healthcare provider and supplier whether renting or buying makes the most sense for your situation.

Final Thoughts

Ok, I hope that all makes sense.

I also hope I didn’t make the process sound more complicated than it really is.

If you have Medicare insurance and feel you need a wheelchair, you should really only have to schedule an appointment with your doctor to get assessed for your medical necessity.

In most cases, the doctor’s office will take it from there (assuming they agree you need a wheelchair) and send the required paperwork to the DME supplier for you.

But, this doesn’t always happen, so it’s a good idea to understand the whole process for yourself.

It’s great, though, that Medicare does cover the majority of the cost for a new wheelchair.

Oh and they’ll usually pay to get you a new wheelchair (or walker) every 5 years, so don’t feel like you need to keep using one that’s not working properly.

Well, that about does it.

I hope you found this guide helpful and if you still have any questions or would like to share any experiences with this process, please leave ’em below and I’ll get back to you soon.