For many seniors, a walker is a key tool that offers the stability and support needed to move around safely, and improve overall independence.

But with the rising costs of medical equipment, the big question is: Does Medicare pay for walkers?

The good news is that Medicare may help cover the cost of a walker, but there are specific rules and requirements that need to be followed.

So, whether you’re dealing with a temporary injury or a more permanent mobility issue, understanding how Medicare’s coverage works for durable medical equipment (DME) like walkers can make a huge difference in getting the support you need without breaking the bank.

In this comprehensive guide, we’ll answer all your questions about Medicare’s coverage for walkers, break down the process of obtaining one through Medicare, and provide helpful tips for navigating the requirements.

After reading, you’ll know everything you need to know to get the right walker for you or your loved one.

Does Medicare Cover Walkers?

Yes, Medicare does cover walkers under Medicare Part B (Medical Insurance), which helps pay for durable medical equipment (DME).

And a walker is considered DME, making it eligible for coverage… if it’s deemed medically necessary (but more on that in a sec).

However, there are certain requirements you must meet to qualify for Medicare to help cover the cost of a walker.

Types of Walkers Medicare Covers

Medicare covers several types of walkers, including:

- Standard Walkers: These walkers have four non-wheeled legs and require you to lift and move them as you walk.

- Front Wheeled Walkers: These walkers come with wheels on the front two legs and no wheels on the back two legs and they’re the most commonly used walkers for seniors. These are great because they offer a great combination of mobility and stability.

- Rollators: These walkers have wheels on all four legs, making them easier to push, and most also have a built-in seat, giving you somewhere to sit anytime you need a break. These walkers are great for walking outside, but with four wheels, you have to make sure you don’t let them get away from you.

Each type of walker serves different needs, and your healthcare provider can help determine which one is best suited to your mobility level.

Requirements for Medicare to Cover Walkers

Medicare has specific conditions that must be met for walkers to be covered. Here’s what you need to know:

- Medically Necessary: Your walker must be considered medically necessary by a healthcare provider. This means that your doctor or healthcare provider must prescribe the walker to treat or manage a medical condition that impairs your mobility.

- Doctor’s Order: Your doctor must provide a written order (prescription) stating that a walker is needed. This prescription must be from a doctor enrolled in Medicare.

- Medicare-Approved Supplier: You must get your walker from a supplier that participates in Medicare and accepts Medicare assignment. This means that the supplier agrees to accept the amount that Medicare pays as full payment for the equipment.

- Meeting Medicare Eligibility: You need to be enrolled in Medicare Part B to qualify for durable medical equipment coverage.

How Much Will Medicare Pay for a Walker?

Under Medicare Part B, Medicare typically covers 80% of the approved cost of your walker, leaving you responsible for the remaining 20%.

Additionally, you must have met your Part B deductible for the year before Medicare begins covering its portion.

In 2024, the Part B deductible was $240 (but it may increase from year to year).

Here’s an example breakdown:

- Cost of walker: $200

- Medicare pays: $160 (80%)

- You pay: $40 (20%) + any unmet deductible

Note: if you have Medigap (Medicare Supplement Insurance), it may cover the remaining 20% coinsurance cost.

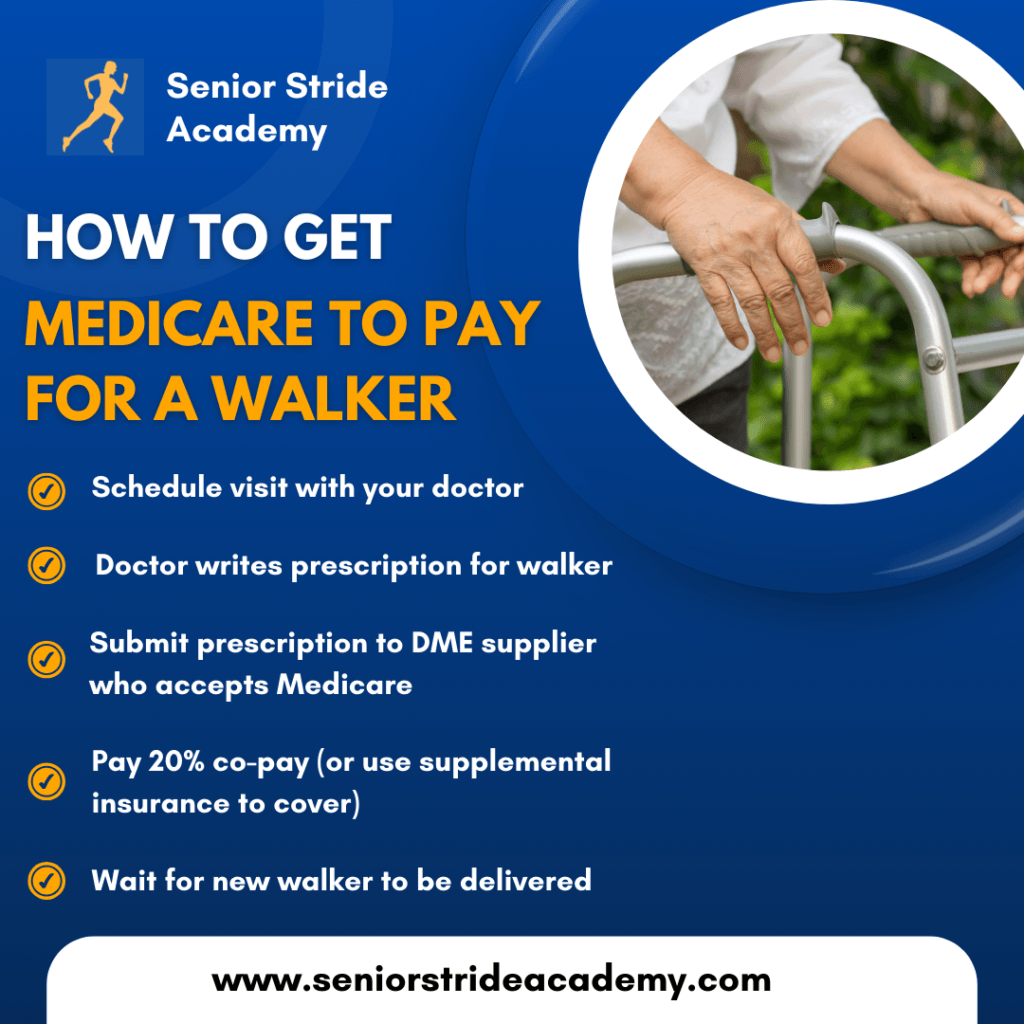

How to Get a Walker Covered by Medicare: Step-by-Step

If you’re ready to get a walker through Medicare, here are the steps you’ll need to follow:

1. Visit Your Doctor

The first step is to schedule an appointment with your doctor to discuss your mobility issues.

If your doctor determines that a walker is medically necessary, they will write a prescription for one.

2. Choose a Medicare-Approved Supplier

Next, find a supplier that accepts Medicare.

You can use Medicare’s Supplier Directory to search for approved DME suppliers in your area.

Make sure the supplier accepts Medicare assignment to ensure you’re only responsible for the 20% coinsurance.

Many doctors have DME suppliers that they use often and will be able to send their walker prescription directly to them, without you having to get involved.

That said, this isn’t always the case.

As a physical therapist, I sometimes find myself playing the middle man, relaying info between the doctor’s office and the DME supplier.

I sometimes have to recommend DME suppliers to doctor’s offices as well.

But the easiest (and usually fastest) scenario is when your doctor’s office already has a DME supplier in mind and can send the order over directly.

3. Submit Your Prescription

However, in the case where your doctor simply gave you a prescription for a walker, you’d have to submit it to a DME supplier in your area.

Give your Medicare-approved supplier the prescription from your doctor and they will process your order and submit the claim to Medicare for payment.

Honestly, once you sent the prescription to the DME company, they’d likely have to contact your doctor’s office for additional information (demographics sheet, insurance info, latest visit nots, etc).

4. Pay the 20% Coinsurance

Once Medicare approves the claim, you’ll be responsible for paying the 20% coinsurance and any unmet Part B deductible.

5. Receive Your Walker

Once the order is processed and the payment is made, you’ll receive your walker, and you can start using it to improve your mobility.

But What If Medicare Doesn’t Cover My Walker?

If you don’t meet Medicare’s criteria for walker coverage for any reason, don’t give up hope – there are still other options available:

- Medicaid: If you qualify for Medicaid, it may help cover the cost of a walker. Medicaid coverage varies by state, so check with your local Medicaid office for details.

- Private Insurance: Some private health insurance plans may cover walkers or other mobility aids as well. Be sure to review your plan’s DME coverage to see what they’ll cover.

- Out-of-Pocket: Don’t forget, you can always purchase a walker on your own. While this option requires full payment upfront, it gives you the freedom to choose any walker you like, even if it’s not covered by Medicare. It’s often a faster route too for seniors who don’t want to wait.

- Charities and Assistance Programs: Some local charities or non-profit organizations offer assistance to seniors who need mobility aids like walkers but can’t afford them.

Medicare Advantage Plans and Walkers

If you have a Medicare Advantage (Part C) plan, your coverage for walkers may differ from Original Medicare.

Medicare Advantage plans are required to cover the same items as Medicare Part B, but they may have different rules about copays, deductibles, or approved suppliers.

Be sure to contact your Medicare Advantage plan provider to confirm your coverage details and learn about the process for getting a walker.

Final Thoughts

Walkers can be a vital tool for seniors to maintain their mobility and independence and the good news is that Medicare often covers most of the cost if you meet certain requirements.

By working with your doctor and using a Medicare-approved supplier, you can get the walker you need, while keeping costs manageable.

That said, I can tell you from experience that getting a walker through Medicare can take awhile sometimes (weeks).

A lot of it boils down to how long it takes for your doctor to get the necessary paperwork to the DME supplier, but the suppliers can also be slow with delivery.

I don’t want to be too pessimistic though, because sometimes everything works out smoothly.

However, if you have the means and need a walker sooner than later, you’re better off purchasing one yourself.

If you decide to purchase one out of pocket, I highly recommend checking Amazon because their prices tend to be much lower than pharmacies.

For example, on Amazon you can expect to pay ~$30 for a quality rolling walker and about $60 for a standard 4-wheel rollator.

I’ve seen comparable rollators sell for $150 at CVS… crazy.

Anyway, long-story-short, Medicare will certainly pay for a walker if you get an order from a doctor and have that order sent to a Medicare participating supplier, but you may still have to pay a 20% copay.

If you have more questions about Medicare coverage for walkers or other durable medical equipment, be sure to contact Medicare directly or consult with a healthcare provider in your area who can guide you through the process.